Net Manufacturer Revenue vs. Revenue Per Location

United States dealers sold $4.5 billion of residential building insulation products in 2019, which included $4.2 billion in net manufacturer revenue and yielded a channel margin of $0.3 billion.

Channel margin in residential insulation is small because $1.4 billion in product is sold direct to builders and contractors: a channel not included in this analysis. The number of U.S. location counts for residential building insulation totaled roughly 17,000 in 2019.

Fifty-two percent of all building insulation was sold direct to dealer in 2019, and 34% was sold direct to builders and contractors. Nearly two-thirds of the product sold direct to dealer went to specialty one-step1. Much of the remaining third went to big box.

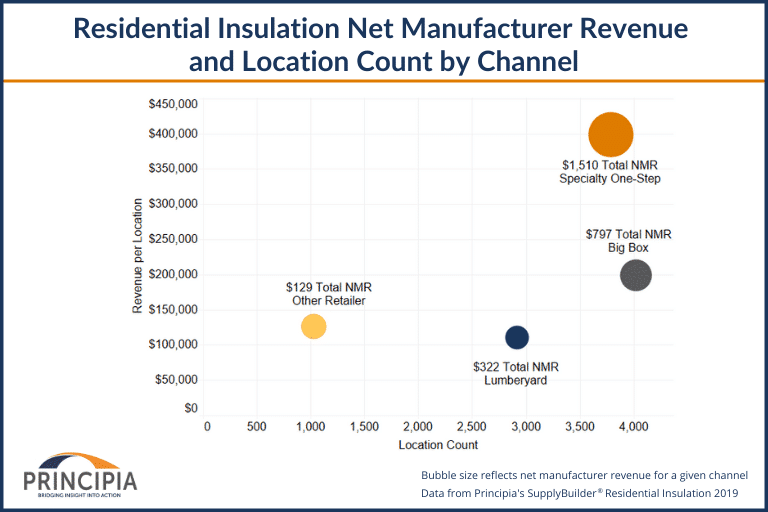

Figure 1 provides net manufacturer revenue and location count by channel. Specialty one-step generates the most overall revenue as well as the highest average revenue per location compared to all other distribution channels.

Figure 1: Net Manufacturer Revenue & Location Count by Channel

Specialty One-Step and Big Box Comparison

Specialty one-step adds value to insulation sales through deep and specialized product knowledge and a broad set of insulation product offerings (fiberglass, stone wool, foam boards, SPF, cellulose) and complementary products (machines & parts, vapor barriers, fasteners, tapes/adhesives, etc.).

Big box adds value in terms of convenience and accessibility, particularly for DIY homeowners undertaking weatherization projects such as adding insulation to attics or basement walls. Easy-to-install fiberglass batts or rolls, foam board, and stone wool are DIY favorites.

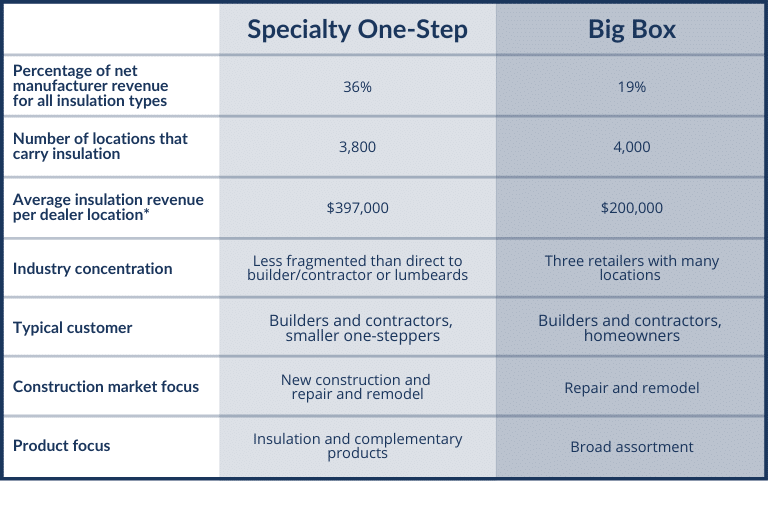

Figure 2 provides a comparison of specialty one-step to big box for residential insulation. Specialty one-step represents 36% of residential insulation revenue and the average insulation revenue per location is almost $400,000. Big box represents 19% of insulation revenue and an average of $200,000 per location.

Figure 2: Specialty One-Step and Big Box Comparison for Insulation

*Net manufacturer revenue by channel divided by the number of locations in channel associated with an insulation brand.

What does this mean for manufacturers?

An analysis of both product revenue by channel and the number of locations provides insights helpful in refining channel strategies.

Specialty one-steppers’ deep inventory and ability to deliver mixed loads keeps contractor relationships sticky. Specialty one-step, however, is facing higher transportation costs, labor shortages, and the need to negotiate to avoid loss to direct, causing some margin compression. Suppliers may utilize one-step or two-step to move product in a direct sale rather than warehouse sale which earns the channel partner lower margins but allows it to retain the business.

If a supplier has limited resources, a big box strategy may be preferable. Demand on supplier resources is lower but revenue per location is lower than specialty one-step. Big box, however, is not a significant channel for certain products. Open cell and closed cell SPF require a skilled installer and specialized equipment. Suppliers of SPF are better off selling direct to builder/contractor or utilizing the one-step channel.

Principia can help industry participants use this information to support their business initiatives. More information about residential building insulation supply and distribution is available for purchase in four product offerings designed to meet your specific needs: Product Supply Snapshot, LBM Dealer Locator, SupplyBuilder®, and BuilderSeries®.

For more information about Principia’s supply and distribution products for residential building insulation, contact us today.

1 Specialty One-Step counts and values include Specialty Insulation Distributors.