Net Manufacturer Revenue vs. Revenue Per Location

United States dealers sold $3.9 billion of residential railing products in 2019, which included $2.2 billion in net manufacturer revenue and yielded a channel margin of $1.7 billion. The number of U.S. dealer locations selling branded residential railing totaled roughly 17,000 in 2020.

Nearly half of all residential railing (47%) was shipped direct to dealer, with outflow to lumberyards and big box, which together accounted for 65% of all railing sold in 2019.

Twenty-three percent of all residential railing was shipped direct to builders and contractors in 2019, a percentage heavily influenced by railing for multifamily high-rise moving through commercial channels.

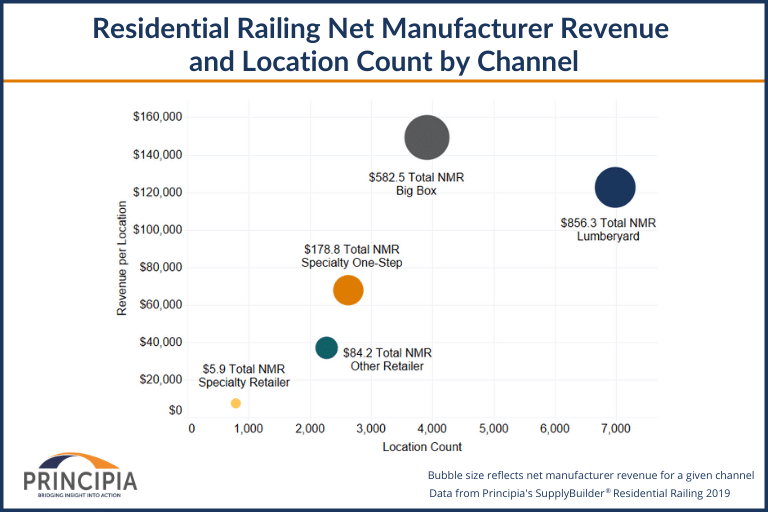

Figure 1 provides net manufacturer revenue by channel along with location counts by channel from Principia’s dealer locator database. The bubble size reflects net manufacturer revenue for a given channel. Lumberyards generate the most overall revenue; big box however has the highest average revenue per location compared to all other distribution channels.

Figure 1: Net Manufacturer Revenue & Location Count by Channel

Lumberyard and Big Box Comparison

Lumberyards add value to railing sales through deep and specialized product knowledge. Lumberyards typically feature indoor displays showcasing supplier offerings, including a variety of product samples, pricing, and accessories like lighting and decorative post caps. Dealers may also build indoor or outdoor deck replicas, giving buyers the ability to touch and compare railing systems. Railing systems, particularly knockdown systems, are more difficult to estimate and order. In addition, personnel at lumberyards have more time and experience to support buyers’ questions on railing products.

Big box adds value in terms of convenience and accessibility, particularly for DIY homeowners who may have made their railing material and profile decision online. A vastly improved online experience through big box websites provides an enhanced product suggestion feature, inventory levels, product information and guides (use and care, warranty, installation instructions, and supplier catalogs).

Both lumberyards and big box take special orders and deliver product in a variety of ways: curbside pickup, pickup in store, or deliver to home.

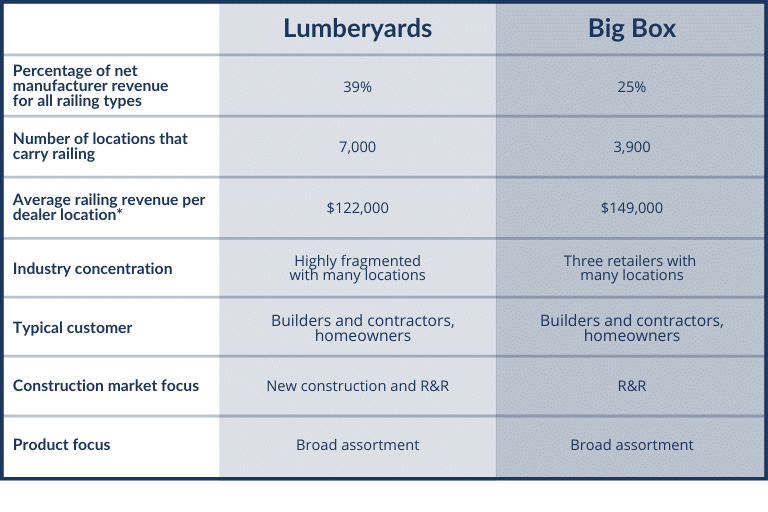

Figure 2 provides a comparison of lumberyards to big box for the residential railing channel. Lumberyards represent 39% of total revenue for all railing types with an average of $122,0001 railing revenue per location. Big box represents 25% of total revenue with an average of $149,000 per location.

Figure 2: Lumberyard and Big Box Comparison

What does this mean for manufacturers?

An analysis of both product revenue by channel and the number of locations provide insights helpful in refining channel strategies. Although there are nearly 80% more lumberyard locations than big box locations selling railing, lumberyards can be considered more challenging to serve as a supplier due to the number of companies, locations and displays required to serve. However, lumberyards offer expertise, merchandising support, and a hands-on approach with customers that railing system suppliers may find preferable, particularly if a product is new to the market and needs to be actively sold. On the contrary a supplier of railing kits with limited resources could find a big box strategy preferable because revenue per location is slightly higher than lumberyards.

Principia can help industry participants use this information to support their business initiatives. More information about residential railing supply and distribution is available for purchase in four product offerings designed to meet your specific needs: Product Supply Snapshot, LBM Dealer Locator, SupplyBuilder®, and BuilderSeries®.

For more information about Principia’s supply and distribution products for residential railing, contact us today.

1Specialty One-Step counts and values include Specialty Insulation Distributors.